Big data for trusted green shipping

By Laurent Barbagli, Meetrisk and IUMI Data & Digitalization Forum

500 million signals are sent by the worldwide fleet each day and this is gold for green shipping. Insurers must seize this data and capture its value.

What is at stake for marine insurance?

The client’s expectations

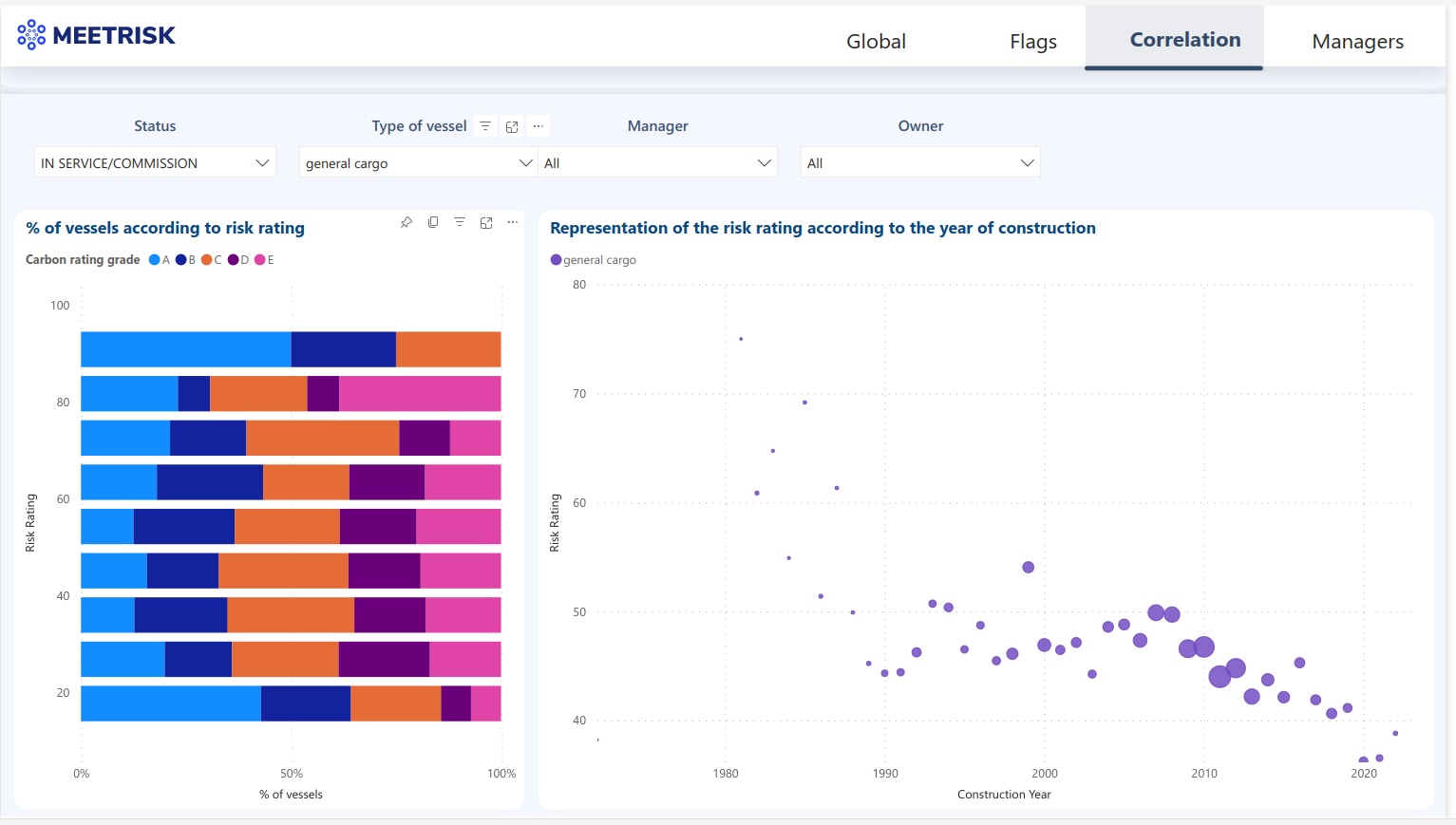

A need for more transparent and objective risk indicators: The most advanced clients are investing a lot into data: the same trend for marine insurance will improve the risk knowledge and its interactions with green shipping performance.

Identifying new risks in a fragmented world: New risks are arising linked to war, sanctions, business pressure, route bottlenecks with more accidents, new processes (new fuels can lead to a machinery breakdown). In this context, it is key to:

- Identifying weak signals of risks and developing predictive risk management.

- Providing transparent and objective risk and carbon indicators, easy to understand and to use.

Better mastering of data: Recent automation on data use has been pushed by the data providers and marine insurtechs. The next step is to tackle both the increasing volume of data and the different types of data in the insurance DNA and then industrialise its transformation into actionable indicators.

The challenge of a de-risked energy transition

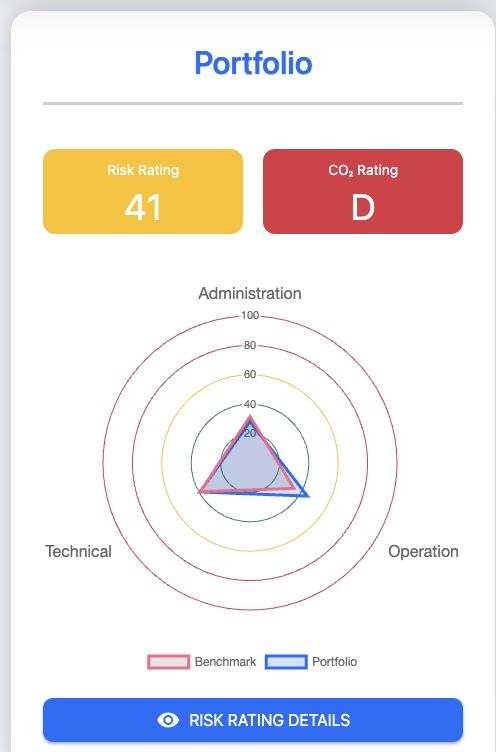

Addressing risk and green shipping stakes: Powerful data science tools make it possible to follow at the same time risk trends and green shipping stakes to support a de-risked energy transition by:

- Decompartmentalising the use of data and mutualising it (e.g. an engine characteristic can feed both risk assessment and carbon impact).

- Identifying correlations or decorrelations between risk performance and carbon performance.

Insurers and insurtechs working together for profitability and sustainability: The data and tech ecosystem alongside the insurers is ready to support this ambition. The first successes involving both insurers and insurtechs show it is achievable! This is why our conviction is that marine insurance portfolios will be managed using both risk and green shipping performance indicators. These indicators will be decision-drivers serving both insurance profitability and sustainability.